Those who have a loan in Kazakhstan and if they have not paid it for a year ,they can be forgiven. This is a possibility specified in the draft law on personal bankruptcy. The document will soon be presented to the deputies for discussion, the reporter of "Adyrna" reports with reference to "Khabar24".

According to the TV channel, 96 percent of Kazakhstani people with problematic debts are those who have taken loans without collateral. Therefore, they can benefit from the bankruptcy law. In order to cancel the debt, the outstanding amount should be up to 5 millions tenge. Also, citizens whose income does not reach the subsistence level can use the out-of-court bankruptcy procedure.

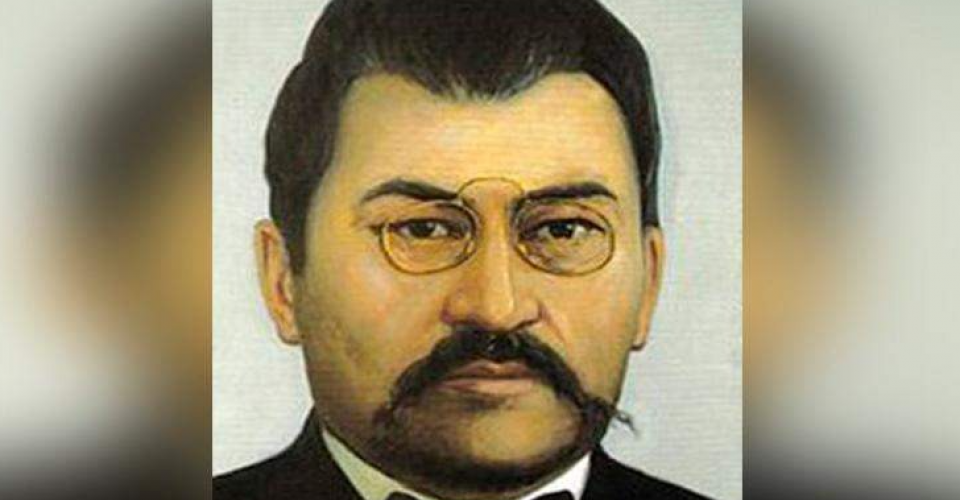

Vice Minister of Finance Yerzhan Birzhanov warned that the debtor should not have any property. The availability of income and property is determined through the electronic government portal. All authorized state bodies that keep records of property integrate the database. After that, banks carry out money movement on settlement accounts. Out-of-court bankruptcy can be applied for debts to banks, microfinance organizations and collection agencies. You have to wait half a year for a decision on the application.

"For example, let's say the legislation worked next year. If it is declared bankrupt in 2023, it is possible to apply for the subsequent procedure after 7 years. Monitoring of the financial situation is carried out within three years after the bankruptcy. Such experience exists in other European countries. This is because such an approach is used to check a deliberately created bankruptcy procedure," said Vice Minister of Finance Yerzhan Birzhanov.